What is a W-9 form and why is my customer asking for it?

So one of your customers has asked you to complete a W-9 form before they can pay you. Why do they need this form that asks for your tax classification and tax ID number? The short answer is – the IRS. The IRS requires companies to add up all the “reportable” payments made to vendors and independent contractors during the calendar year and report these payments to the IRS. This requirement is similar to the way that companies have to report all wages paid to employees. However, before filling out the W9, you may want to make sure that you’re correctly classified as a contractor vs. being an employee.

These payments are typically reported to the IRS on Form 1096 and to the vendor or independent contractor on Form 1099. The combination of your tax classification (for example – individual, corporation or LLC) and the type of payment made (for example – payments for services, attorneys fees or rent) determines what must be reported to the IRS. Payments for “services” to “individuals” are reportable. However, most payments to “corporations” for “services” are not reportable. Your social security number or employer identification number is needed to specifically identify you to the IRS.

The whole process of this reporting is called “information reporting.” In essence, the IRS is requiring companies to track and then “report” payment “information” that would typically be considered income on your income tax return. What does the IRS do with this information? They compare the income reported on the vendor or independent contractor’s income tax return against all the income reported on the 1099 and W-2 forms. If the income reported on the tax return is less than the sum of income reported on the 1099 and W-2 forms, the tax return will be flagged to review for under-reported income and consequently underpaid taxes.

Stop using your Social Security Number!

If you work as an independent contractor or sole proprietor you can use an Employer Identification Number (EIN) on your W-9 form and avoid using your Social Security number (SSN). Apply for an instant EIN number for free at irs.gov. Online hours for the IRS EIN service are Monday – Friday, 7am to 10pm EST. Note that independent contractors are considered sole proprietors by the IRS and eligible for an EIN number. It is also not necessary to have employees to obtain an EIN.

U.S. person

The W-9 form should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.

If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8

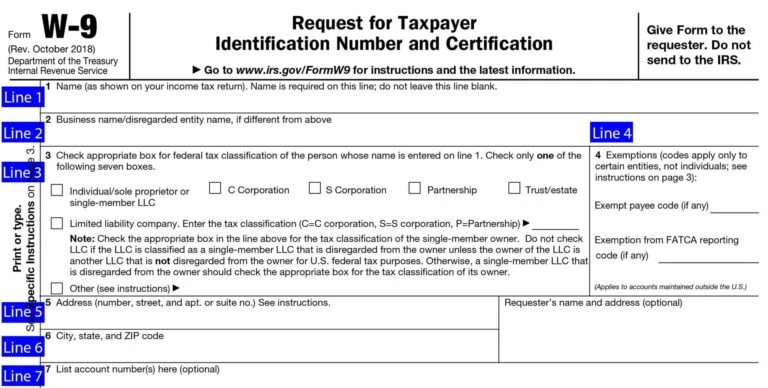

To get started, download the latest W-9 form from the IRS website. Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read “Rev. October 2018″.Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 form then save the form to your desktop and reopen using Adobe Acrobat Reader

How to fill out your W-9 form

L

L

ine 1 – Name: This line should match the name on your income tax return. This the legal name of your as an individual or as a company.

Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. The purpose of line 2 is to help identify your company to your customer if the name on Line 1 is not one commonly known by your customer.

Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1.

Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 check the “Limited Liability Company” box and in the space provided enter “C” for C corporation. If the LLC has filed Form 2553 to be taxed as an S corporation, check the “Limited Liability Company” box and in the space provided enter “S” for S corporation. If the LLC is a single-member LLC (a disregarded entity), do not check the “Limited Liability Company” box; instead select the tax classification of the owner of the LLC. If the owner of the LLC is another single-member LLC select the first owner that is not a single-member LLC.

Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.

Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with the W-9 form for more detailed information on exemptions.

Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the W-9 form will mail your information returns to.

Line 6 – City, state and ZIP: Enter your city, state and ZIP code.

Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.

Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.

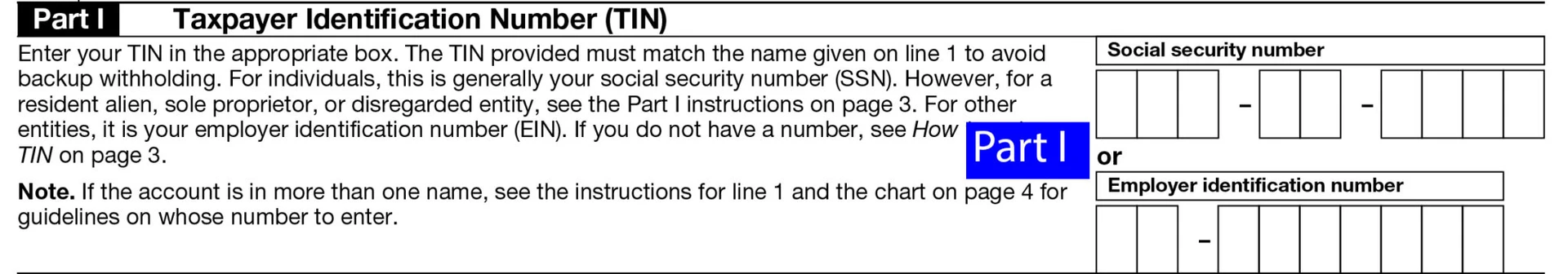

Third Step – Enter your TIN number

Part I – Taxpayer Identification Number (TIN): Enter your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company.

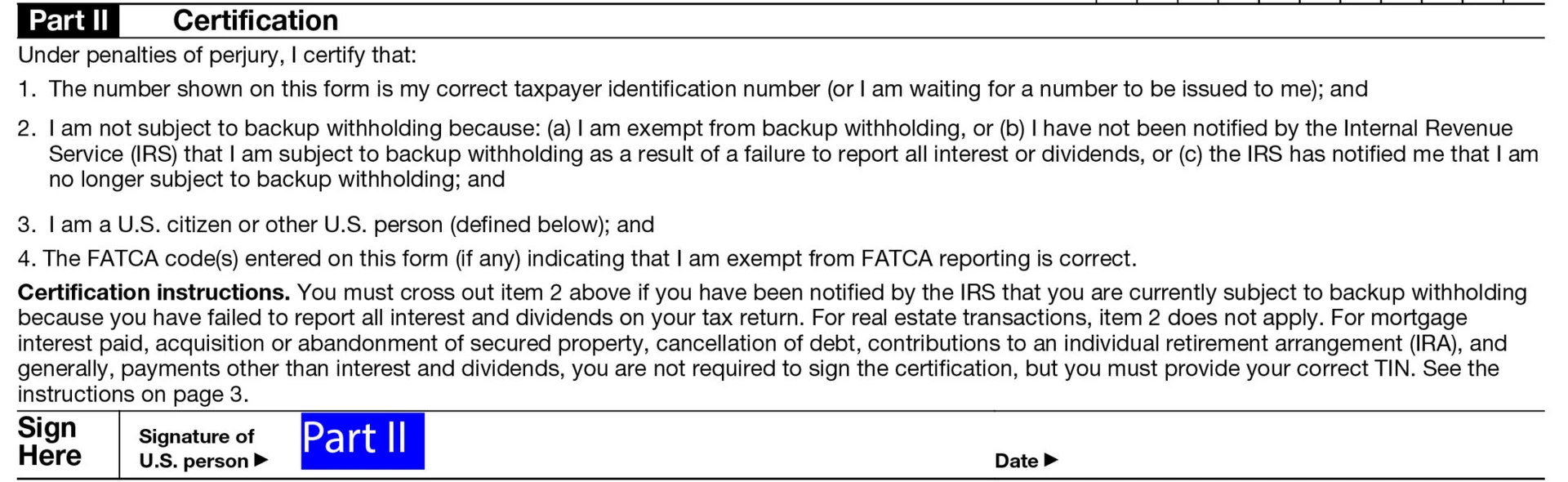

Fourth Step – Sign your W-9 Form

Part II – Certification: Sign and date your form.

IRS will recalculate taxes on 2020 unemployment benefits and start issuing refunds in May

Normally, unemployment compensation is taxable. However, a recent law change allows certain recipients to not pay tax on a portion of their 2020 unemployment compensation.

Under the new law, taxpayers who earned less than $150,000 in modified adjusted gross income can exclude some unemployment compensation from their income and do not have to pay tax on it. People who are married filing jointly can exclude up to $20,400 – up to $10,200 for each spouse who received unemployment compensation. All other eligible taxpayers can exclude up to $10,200 from their income.

Information for people who already filed their 2020 tax return

For taxpayers who already have filed and figured their 2020 tax based on the full amount of unemployment compensation, the IRS will automatically refund money to eligible people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan. These refunds are expected to begin in May and continue into the summer.

The agency will do these recalculations in two phases.

- First, taxpayers who are eligible to exclude up to $10,200.

- Second, those married filing jointly who are eligible to exclude up to $20,400, and others with more complex returns.

Taxpayers who included unemployment payments as income when they did not have to, do not need to file an amended return. Taxpayers only need to file an amended return if the recalculations make them newly eligible for additional federal tax credits or deductions not already included on their original tax return.

For example, the IRS may adjust returns for taxpayers who claimed the earned income tax credit and, because the exclusion changed their income level, they may now be eligible for an increase in the EITC amount.

However, taxpayers would have to file an amended return if they did not originally claim the EITC or other credits but are now eligible to claim them following the change in the tax law. Taxpayers can use the EITC Assistant to see if they qualify for this credit based upon their new taxable income amount. If they now qualify, they should consider filing an amended return to claim this money.

These taxpayers may want to review their state tax returns as well.

Information for people who haven’t filed their 2020 tax return

If you haven’t filed your 2020 return yet, tax preparation software has been updated to reflect these changes. People who haven’t yet filed and choose to file electronically, simply need to respond to the related questions when preparing their tax returns. These taxpayers should read New Exclusion of up to $10,200 of Unemployment Compensation for information and examples. For those who choose to file a paper return, instructions and an updated worksheet about the exclusion are available on IRS.gov.

Share this tip on social media — #IRSTaxTip: IRS will recalculate taxes on 2020 unemployment benefits and start issuing refunds in May. https://go.usa.gov/xHrxZ